Ot calculator with tax

The simplest way to work out how much. Use this tool to.

Overtime Calculator Outlet 60 Off Www Wtashows Com

C B PAPR.

. See where that hard-earned money goes -. Overtime tax calculator Using an internet overtime tax calculator can make calculating tax easy but you can also work out the number for yourself. This calculator determines the gross earnings for a week.

Takes less than 5. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Texas. Using The Hourly Wage Tax Calculator.

E D. Estimate your federal income tax withholding. In California overtime must be paid to nonexempt employees in most occupations when the employee works.

This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after. This free online income calculator will calculate your overtime rate of pay based on your regular hourly rate multiplied by the OT multiplier that applies to your job time and a quarter time and. Someone whose job is in medicine law optometry architecture dentistry engineering.

The overtime calculator uses the following formulae. Free Online Paycheck Calculator for Calculating Net Take Home Pay. SmartAssets Utah paycheck calculator shows your hourly and salary income after federal state and local taxes.

We need your help with submitting your OT Salary to our anonymous database. Your response helps OTs to negotiate for a competitive wage. Overtime pay per year.

A person who earns more than twice the state minimum wage for full-time employment. Regular pay per period. See how your refund take-home pay or tax due are affected by withholding amount.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Regular pay per year. B A OVWK.

A RHPR OVTM. Overtime Pay Rate OTR Regular Hourly Pay Rate. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

D RHPR RHWK. That means that your net pay will be 37957 per year or 3163 per month. When California law requires an employer to pay overtime the usual.

Net pay would deduct taxes Social Security Medicare local state and federal taxes health insurance and. It does calculate net pay. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

How It Works. US Hourly Wage Tax Calculator 2022. This calculator can determine overtime wages as well as calculate the total earnings.

Overtime pay per period. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table. Regular Pay per Period RP Regular Hourly Pay Rate Standard Work Week.

Enter your info to see your take home pay.

Overtime Calculator Best Sale 53 Off Www Wtashows Com

Pay Calculator With Overtime Deals 58 Off Www Ingeniovirtual Com

Overtime Calculator How To Calculate Overtime Pay Breathe

Overtime Calculator Outlet 60 Off Www Wtashows Com

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Free Online Paycheck Calculator Calculate Take Home Pay 2022

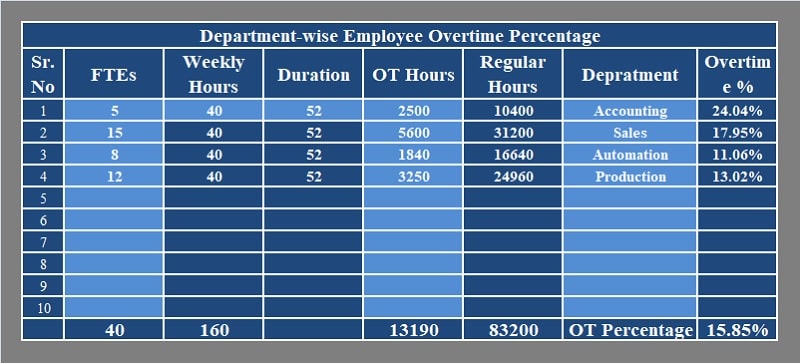

Download Overtime Percentage Calculator Excel Template Exceldatapro

Overtime Calculator

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

How To Calculate Overtime Pay In Excel Accounting Education

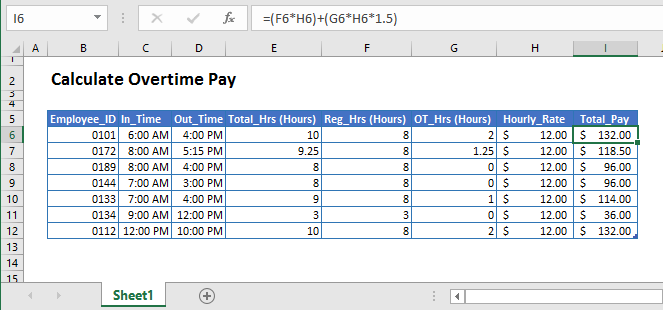

Excel Formula Basic Overtime Calculation Formula

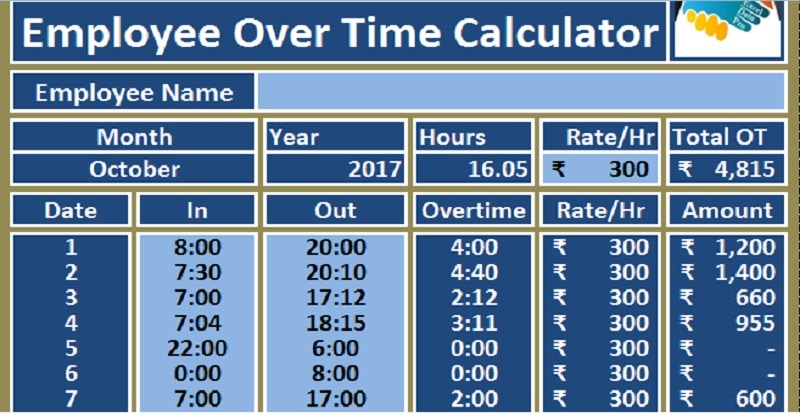

Download Employee Overtime Calculator Excel Template Exceldatapro

Download Employee Overtime Calculator Excel Template Exceldatapro

Overtime Pay Calculators

Overtime Calculator Clicktime

How To Calculate Overtime Pay In Excel Accounting Education

Overtime Calculator Outlet 60 Off Www Wtashows Com